Banks, as the backbone of economic development, facilitate capital flows, serve the real economy, and drive overall economic growth by providing financial products and services. In recent years, with the slowdown in economic growth, a low interest rate environment has become the new normal. Additionally, under stringent regulatory requirements, banks face increased pressure for risk management and control. The banking sector urgently needs to seize the opportunity of digital transformation to enhance overall profitability and risk management capabilities, thereby promoting high-quality development.

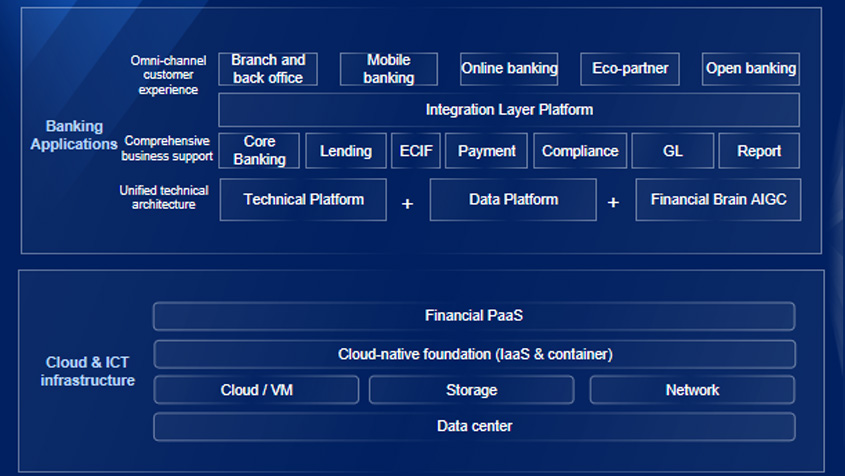

Sm@rtOneBank banking solution, an integrated yet modular offering, addresses the core banking, general ledger, payment, trade finance, credit management, counter system, e-banking, mobile banking and ECIF requirements of universal, retail, corporate and digital banks worldwide. The solution uses micro-services and distributed technologies, combines the latest achievements of open banking and digital transformation in the financial industry, and is based on the advanced concepts and best practices of DCITS in international finance.

-

Out-of-the-boxAn all-in-one solution, ready to deploy with rapid go-live, driving quick profits while minimizing system construction and operational costs.

Out-of-the-boxAn all-in-one solution, ready to deploy with rapid go-live, driving quick profits while minimizing system construction and operational costs. -

Advanced architecturePowered by DCITS’ ModelBank 5.0 architecture, it helps banks achieve customer-centric digital transformation, enabling innovative financial scenarios, customization, and fast product upgrades.

Advanced architecturePowered by DCITS’ ModelBank 5.0 architecture, it helps banks achieve customer-centric digital transformation, enabling innovative financial scenarios, customization, and fast product upgrades. -

Excellent performanceUtilizing cutting-edge micro-services and distributed architecture, it supports cloud-native, flexible deployment, ensuring unlimited horizontal scalability and high performance.

Excellent performanceUtilizing cutting-edge micro-services and distributed architecture, it supports cloud-native, flexible deployment, ensuring unlimited horizontal scalability and high performance. -

Full-featured IntegrationComprehensive business functionality integrates lending, payments, general ledger, credit, and e-banking systems, offering end-to-end banking services.

Full-featured IntegrationComprehensive business functionality integrates lending, payments, general ledger, credit, and e-banking systems, offering end-to-end banking services. -

Flexible optionsWith a flexible 1+N modular design, a unified technical foundation plus multiple business modules meet the diverse needs of banks.

Flexible optionsWith a flexible 1+N modular design, a unified technical foundation plus multiple business modules meet the diverse needs of banks.

-

Unified Management and Increased Efficiency:

Unified customer management, account model, parameter platform, product management functions, interface and operation platform, etc. improve operation and management efficiency.

-

Rapid to Market:

The modular architecture, high degree of parameterization and a flexible product factory enable banks to bring products or services to market quickly.

-

Cost Savings:

A full-featured banking system significantly reduces initial investment and ongoing operational costs.

-

Enhanced Customer Experience:

The integrated system enables banks to provide a consistent and comprehensive customer experience, enhancing customer stickiness and loyalty.

-

Future-Proofing:

The system can adapt to future technological advancements and regulatory changes with open standards and a flexible architecture.